Australian hotel investment surges in 2023, on the back of improved liquidity and a strong trading recovery says JLL

Contact

Australian hotel investment surges in 2023, on the back of improved liquidity and a strong trading recovery says JLL

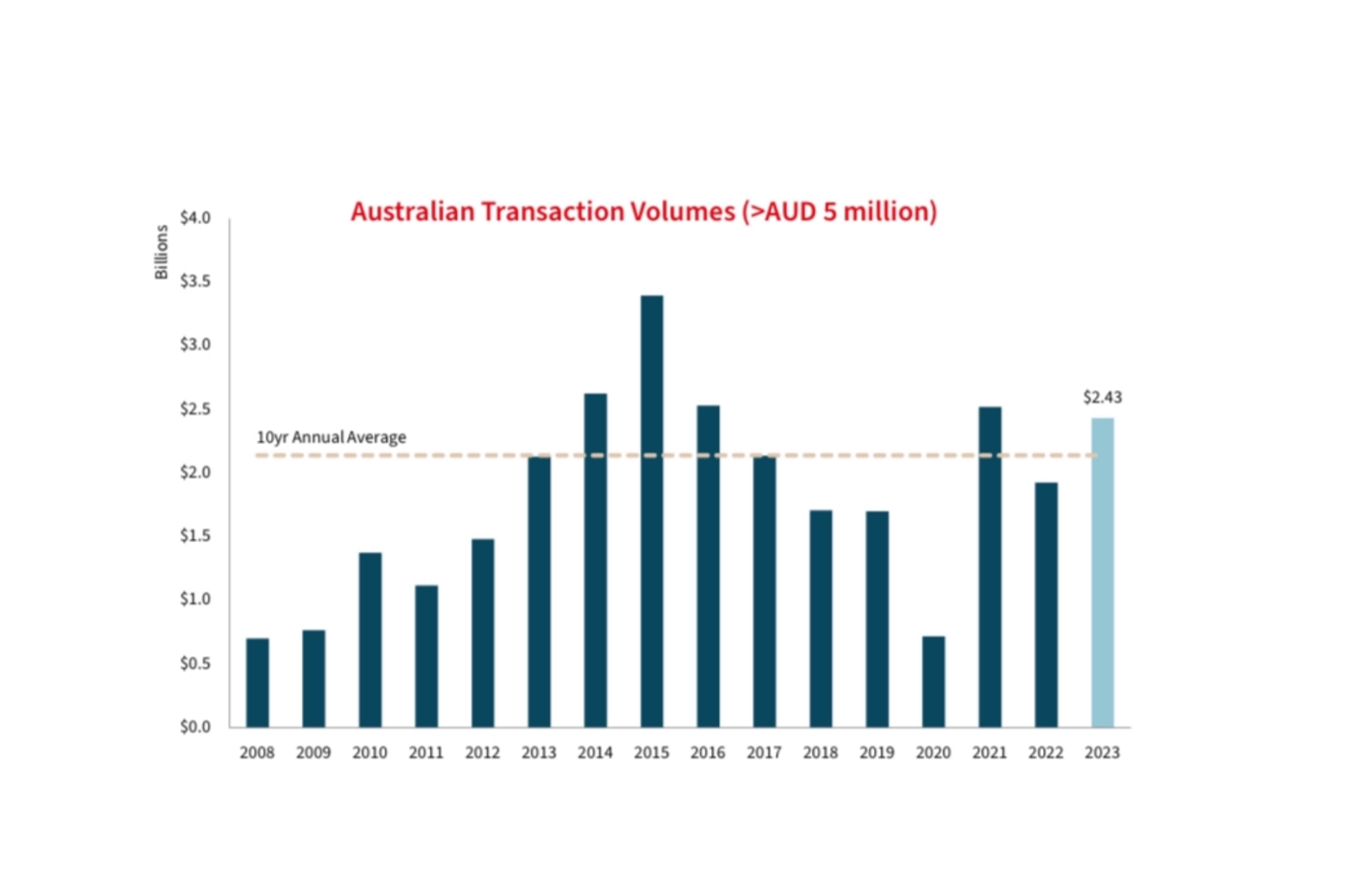

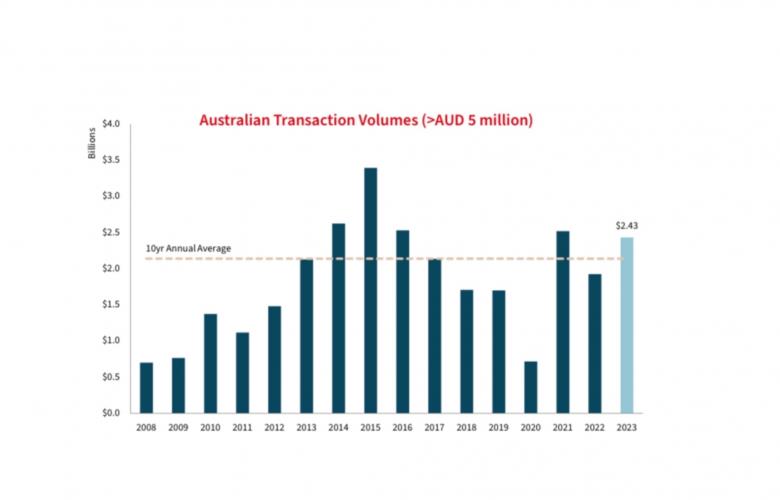

Driven by improved investor sentiment, a continued trading recovery, and several landmark transactions, the hotel investment landscape in Australia experienced strong growth in 2023. Hotel investment volumes (≥ A$5m) reached A$2.43 billion, showcasing a year-on-year increase of 26% and surpassing the 10-year long-term average of A$2.14 billion.

Driven by improved investor sentiment, a continued trading recovery, and several landmark transactions, the hotel investment landscape in Australia experienced strong growth in 2023. Hotel investment volumes (≥ A$5m) reached A$2.43 billion, showcasing a year-on-year increase of 26% and surpassing the 10-year long-term average of A$2.14 billion.

Transaction activity remained robust, with 53 deals settling over the year, encompassing approximately 5,500 rooms. This figure exceeds the previous year's 51 sales (4,100 rooms) and became the highest number of transactions reported annually since 2015’s record breaking year (57 deals, 10,600 rooms).

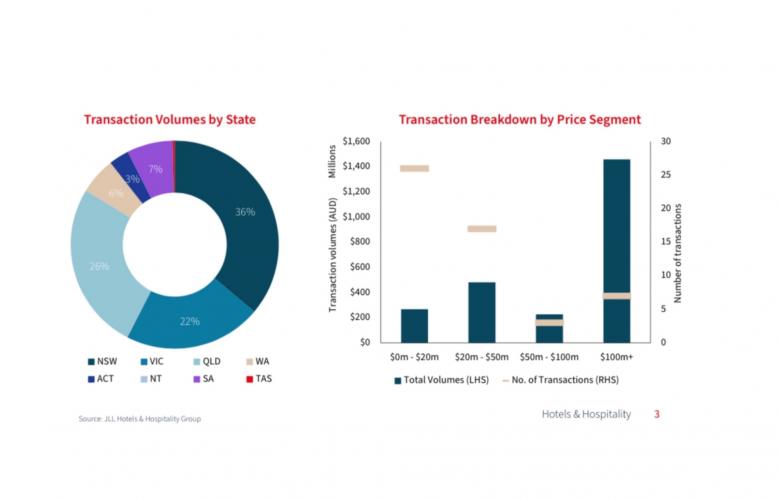

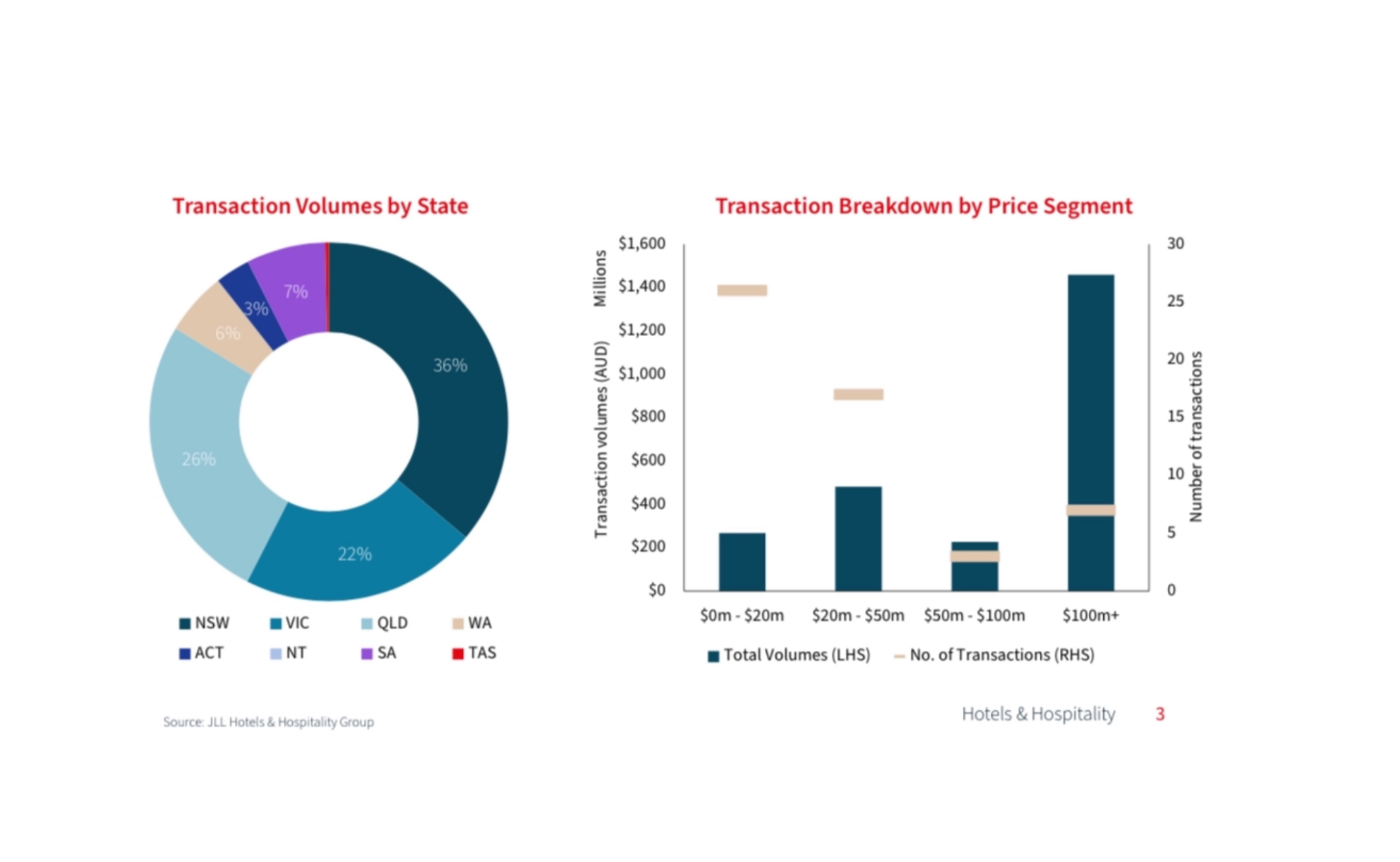

Deal volumes were largely concentrated in the three Eastern Seaboard states, as is typically observed, and represented nearly three-quarters (74%) of the overall volumes. This was led by New South Wales, accounting for 32% of total volumes or A$779 million, primarily due to the forward-funding of the Waldorf Astoria Sydney development project. The next most active markets were Queensland (23% - A$564 m) and Victoria (19% - A$461 m), with most city markets witnessing positive year-on-year increases in investment volumes.

“Queensland was arguably the standout performer of any state over 2023, recording its largest annual transaction volume since 2015 (A$742m). This was driven by both strong domestic and offshore interest, a market leading trading recovery over the past two years, and the significant investment going into the state’s South East in the lead up to the Olympic Games”, said Adam Bury, Executive Vice President, Investment Sales & Head of Hotel Debt Advisory, JLL Hotels & Hospitality Group.

"Further, buyer interest covered many of the capital cities including significant transactions in Sydney, Melbourne, Brisbane, Gold Coast and Adelaide, showing the depth and breadth of investor demand within the market”.

Domestic buyers and local capital continued to dominate capital flows, constituting 79% of total investment volumes (approximately $1.93 billion), however many of these investors have offshore limited partners. Meanwhile, direct offshore investment contributed 21% of total investment volumes (approximately $500 million), primarily from groups out of Singapore such as Invictus Developments, City Developments Limited (CDL), and Worldwide Hotels Group.

The first half of the year recorded a large proportion of total transactional activity, which was largely attributed to an active end to 2022 and higher levels of investor activity prior to the consecutive cash rate increases. Approximately $1.77 billion worth of deals were settled and exchanged during this period, comprising 73% of the annual volumes, including several trophy transactions that ended up being finalised in the fourth quarter.

“In a strong sign of investor appetite towards suitable opportunities, JLL settled five of the market’s final deals for 2023. This included the largest ever recorded single asset transaction on the Gold Coast, the Sheraton Grand Mirage (A$192 m), followed by Vali Byron Bay (A$29.1 m) and Angourie Resort (A$25 m) in New South Wales, Mercure Kawana Waters (A$21.3 m) in Queensland and the Seasons of Perth (A$22.5 m) in Western Australia,” said Gus Moors, Managing Director, JLL Hotels & Hospitality Group.

“Other notable transactions across the country included Melbourne’s Adelphi Hotel (A$25 m) and Fraser Place (A$32.4 m), and portfolios sales such as Spicers Retreats (A$130 m) and Escarpment Group (A$115 m)”.

“The Australian Hotel Market continues to showcase immense resilience and attractiveness to investors, supported by improved liquidity and robust trading growth.

Importantly, the market continues to attract significant interest from global investors, particularly from groups out of Asia, who are looking to deploy capital in key markets with strong fundamentals. The continued growth of domestic investors, both from established groups and new entrants to the sector is highly encouraging, with the majority of this capital being attributed to privates, investment funds and developers”, said Peter Harper, Managing Director & Head of Investment Sales Australasia, JLL Hotels & Hospitality Group”.

Mr Harper added, “Anticipating the upcoming year, there is a prevailing cautious optimism that a more certain underwriting environment and favourable trading conditions will sustain investor interest throughout 2024. The strongest interest will remain on aspirational assets, be that emotive or strategic, as well as properties that offer genuine upside through refurbishment and repositioning. Likewise, hotels that lend themselves to the bullish living sector through adaptive use or redevelopment will also remain in the spotlight. This sentiment is particularly evident in major city markets, which are expected to benefit from ever-evolving events calendars and a continued recovery in both international and corporate/MICE demand. We expect the flexible nature of pricing in hotel operations to continue to offer a hedge against inflation, and continue to enhance the attractiveness of our sector”.

Related Reading:

Hospitality Icon Vali, Byron Bay for sale - JLL | The Hotel Conversation

Largest Hotel transaction on the sunshine coast in over five years - JLL | The Hotel Conversation

Salter Brothers confirm their acquisition of Spicers Retreats | The Hotel Conversation

Salter Brothers acquires luxury boutique hotel & estate portfolio in NSW | The Hotel Conversation