Hotel investors ride out economy at high end of town as Premium assets redefine market - Colliers

Contact

Hotel investors ride out economy at high end of town as Premium assets redefine market - Colliers

Transaction volumes for Premium hotels increased by 20.9% last year, as investors bet on continued high-performance and resilient pricing, according to Colliers Hotels Investment Review 2023 commented Colliers Head of Hotels Transaction Services Karen Wales.

Transaction volumes for Premium hotels increased by 20.9% last year, as investors bet on continued high-performance and resilient pricing, according to Colliers Hotels Investment Review 2023.

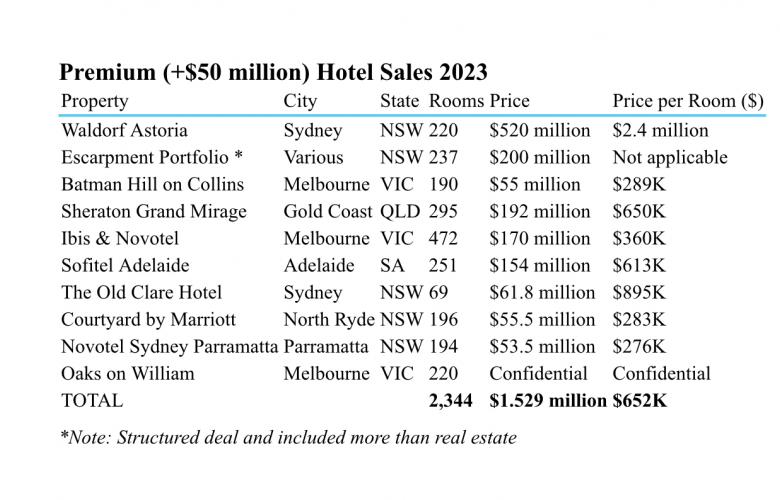

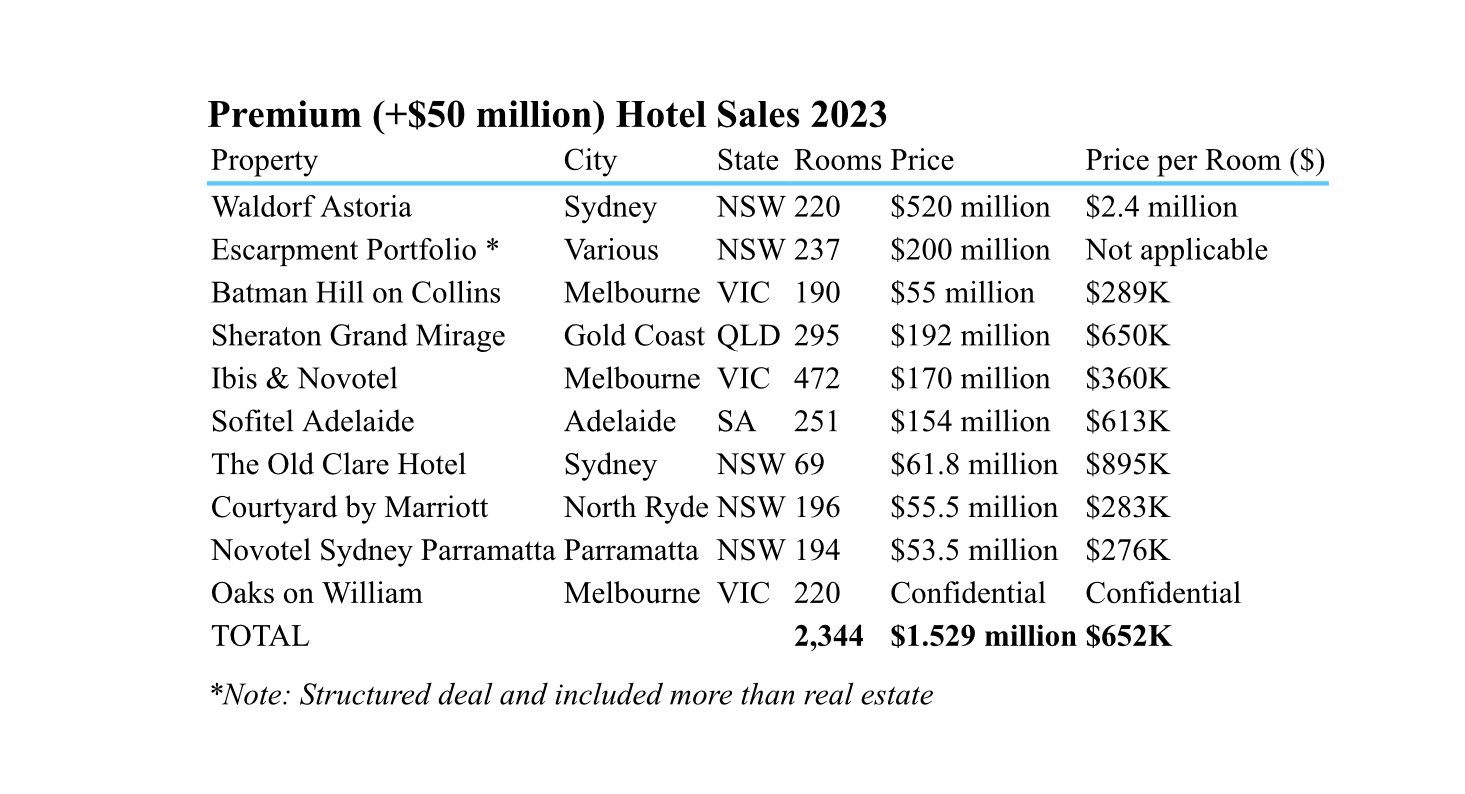

Australia’s growing Premium hotels (above $50 million) segment defies the uncertain economic climate and proves crown jewel of the market, with the transaction volume for hotels over $50 million reaching $1.53 billion or 63% of overall hotels investment last year.

An increase in the Premium hotel transaction volume by 21% in 2023 ensured the average hotel sale jumped 19.1% to $41.8 million over the same period, as pricing for Premium properties in gateway cities and leisure markets remains robust, according to Colliers Head of Hotels Transaction Services Karen Wales.

“Investors see the opportunity presented by improving demand levels, which supported increases in room rates across key markets of 20-50%, compared to 2019.” Ms Wales said.

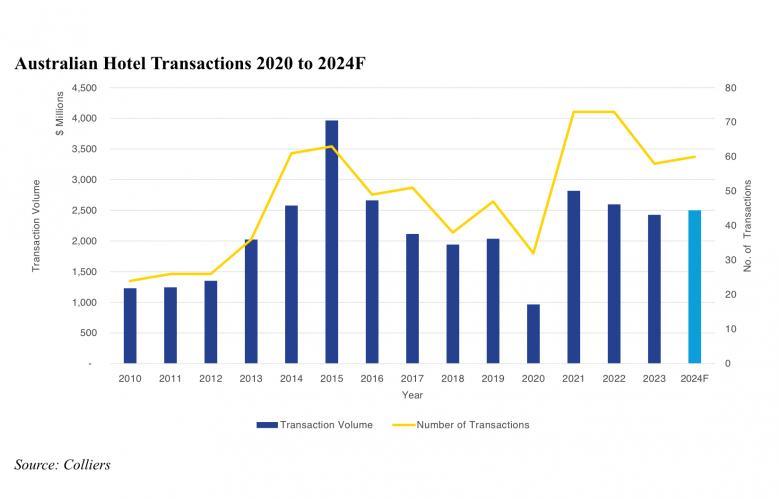

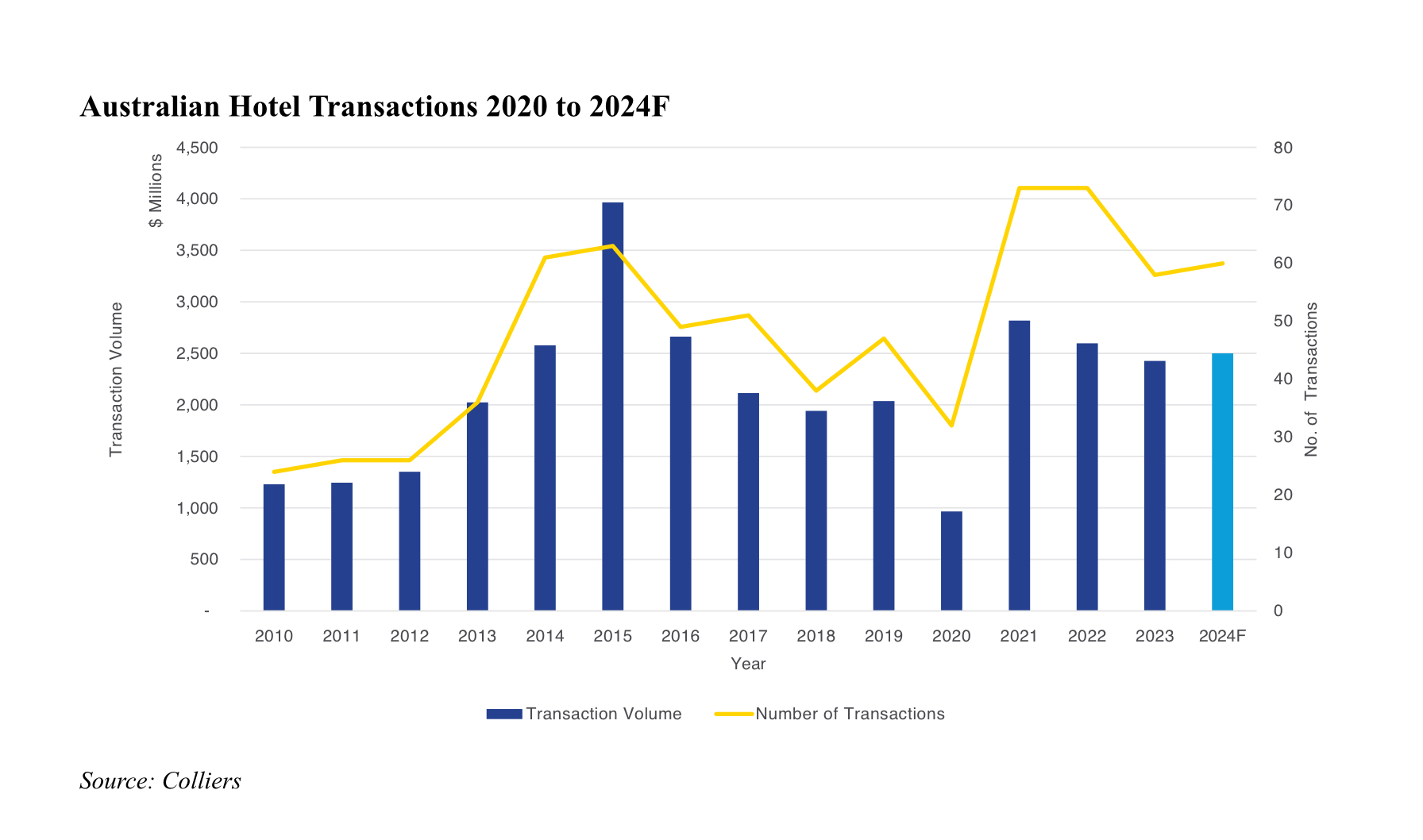

“Positive sentiment around recovery in travel and asset performance continue to be key investment drivers across the hotels market, ensuring investment volumes held up well last year compared to other commercial property asset classes, decreasing only 7% compared to 2022 to $2.4 billion.

“While established portfolio hotel owners accounted for 87% of transactions in 2023 and acquired all ten Premium assets on the market, the hotels sector continues to attract new investors with lower cap rate expansions and more capital targeting quality opportunities across the burgeoning sector.”

In a marked turnaround, domestic investors accounted for 77% of transactions last year, a level of deal flow which has not been witnessed since 2006, for this buyer segment. However, offshore investors are expected to play a more active role over 2024, expanding on the $30 billion of Premium hotels they currently own.

Many opportunistic funds held onto dry powder or slowed down acquisitions as external pressures built, with the belief that better buying will materialise in 2024, according to Colliers National Director of Hotels Neil Scanlan.

“A superior level of due diligence and asset level performance will become more important for purchasers than in recent years when low interest rates, competitive capital flows, and cap rate compression lifted the market overall.” Mr Scanlan said.

Premium hotels are anticipated to continue to outperform older competitors with luxury and upscale hotels boasting an average occupancy rate over 70% and a national average ADR of $326 over FY23, according to the Australian Accommodation Monitor.

Sydney’s luxury segment recorded a stellar year, with room rates up 26 per cent compared to pre-Covid, averaging $450 in 2023. This segment also benefited from new ultra-luxury product such as Crown Resort and Capella Sydney, as well as lifestyle luxury brands W and Ace Sydney.

“New stock has been predominantly located in capital cities, but the allure of luxury is now spreading to key leisure destinations, with 1,000 rooms either recently opened or planned for the Gold Coast, across brands such as Langham, Mondrian, St Regis and Ritz Carlton.” Mr Scanlan said.

“Australia’s high performing Premium hotel market has swelled over the past ten years with the development of more than 36,000 new rooms.” Ms Wales added.

“There are now more than 117,000 Premium hotel rooms nationally, with a combined value of almost $60 billion, providing a breadth of opportunity for sophisticated hotel investors.

“The lion’s share of Premium stock is in Sydney, with an estimated value of more than $22 billion.

“Notwithstanding the boom in Premium stock underpinning evolution of the sector, Australia will still be under-represented when it comes to Premium lifestyle hotels, despite more brands coming to our shores throughout 2024, expanding on the currently available 6,000 rooms or 5% of the total Premium hotel market.

“Strategic investors will look past any short-term volatility for long-term returns, which lie with industry megatrends such as lifestyle, sustainability, automation and wellness.

“In contrast to Premium stock, secondary or older assets are appealing to investors targeting the hotel sector for conversion to alternate uses, including Build-to-Rent, co-living or residential as State and Federal Governments tackle a lack of housing supply.

“The uptick in listings seen in Q3 2023, and the fact that there are currently around $2.2 billion assets currently on the market, points to higher levels of investment activity over 2024, and we expect transaction volumes to reach $2.5 billion.

“While 2024 will bring both new challenges and generational opportunities for hotel investors, pent-up demand for travel remains elevated and the sector’s market dynamics indicate progressive recovery to pre-pandemic norms.

“Investing is always about looking to the future, and pre-pandemic investment theses will not necessarily prove beneficial for 2024 and beyond.”

Links below to Notable Premium Hotel Transactions 2023:

Salter Brothers acquires luxury boutique hotel & estate portfolio in NSW | The Hotel Conversation

Salter Brothers acquires first hotel in South Australia – Sofitel Adelaide | The Hotel Conversation

Oaks Melbourne on William suites for sale - Colliers & JLL | The Hotel Conversation