JLL Hotels & Hospitality’s latest Australian Hotel Investment Review & Outlook 2025

Contact

JLL Hotels & Hospitality’s latest Australian Hotel Investment Review & Outlook 2025

Despite a subdued 2024, rebounding investment volumes and renewed offshore interest drives optimism in the Australian hotel market - JLL

Despite subdued overall volumes, the Australian hotel investment market recorded robust transaction activity with strong activity in the mid-markets space and limited institutional-level transactions.

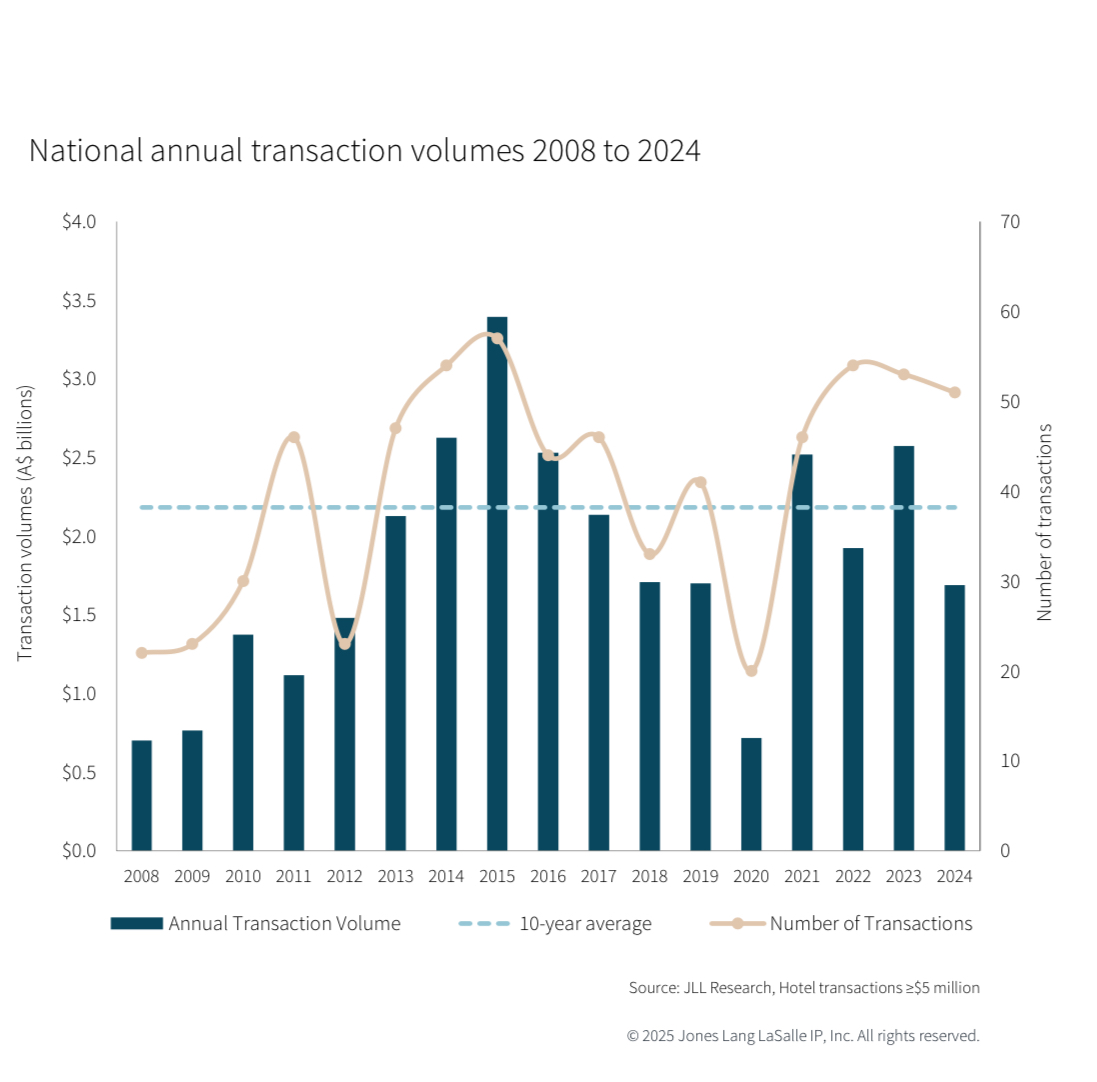

Hotel investment volumes (≥ A$5m) reached A$1.69 billion, with 51 deals settling over the year, encompassing approximately 5,200 rooms. Representing a 34% year-on-year decrease from 2023, and 23% below the 10-year long-term average.

Transaction activity was heavily weighted towards the three Eastern Seaboard states, making up over three-quarters (82%) of overall volumes. New South Wales led with the highest transaction volume at A$739 million (44% of total market share), followed by Queensland (20% - A$335m) and Victoria (18% - A$310m).

"2024 saw a notable increase in metropolitan market activity, accounting for 55% of total volumes (A$921m) and 45% by number of deals. This was largely concentrated in both NSW and QLD, representative of mid-market transaction activity and hotels in prime fringe locations being bought for redevelopment," said Gus Moors, Managing Director, Investment Sales – Australia, JLL Hotels & Hospitality Group.

Domestic buyers continued to dominate capital flows, constituting 81% of total investment volumes (approx.A$1.36 billion), although many of these investors have offshore general or limited partners. Overseas investment (approx. A$327 million) was primarily from groups out of South East Asia.

"We are beginning to see a renewed focus from Asian investors, who are pivoting back from the UK, Europe and Japan, in particular. The largest inbound capital source market, Singapore, has become more active, and we anticipate groups from the likes of Thailand, Malaysia and Hong Kong to really emerge in the investment landscape this year," added Mr Moors.

"For offshore investors, particularly those that trade in USD or who can factor FX into their underwrite, Australian real estate is about as cheap as it gets at the moment," noted Adam Bury, Executive Vice President, Investment Sales, Head of Hotel Debt Advisory - Australia, JLL Hotels & Hospitality Group.

Looking ahead to 2025, transaction volumes are predicted to rebound and sit slightly above the long-term average, at circa A$2.2 billion. This pick-up in activity is likely to result from a favourable interest rate environment outlook, anticipated reduction of the bid-ask spread, strong trading performance, and limited incoming hotel supply across most capital city markets.

"Owing to the ownership profile of Australian hotels, since the rapid increase in the official cash rate in 2022 and peaking in 2023, we have seen minimal sell-side pressure. Consequently, owners were able to hold firm at their pricing levels, and the bid-ask spread was created as a result of the impact that the cost of debt was having on buyers. With further expected cuts over the next 12-months, we expect a better alignment between sell-and-buy-side requirements moving forward," said Peter Harper, Managing Director, Head of Investment Sales – Hotels Australasia, JLL Hotels & Hospitality Group.

“Furthermore, the current high replacement cost environment is driving some groups to pursue a refurbishment and repositioning strategies, while also further supporting the investment thesis of many value-add investors. As a result, assets with good "bones" and strong built-form fundamentals are attracting increased investor attention. Overall, we anticipate capital continuing to target assets that are viewed as aspirational, be that core acquisitions for trophy or strategic properties, as well as those assets with value-add plays over 2025,” added Mr Harper.

For further information or to obtain a copy of JLL Hotels & Hospitality’s Australian Hotel Investment Review & Outlook 2025, please contact:

Peter Harper [email protected]

Gus Moors [email protected]

Adam Bury [email protected]