Depreciation deductions make for smooth sailing

Contact

Depreciation deductions make for smooth sailing

Owning and operating a hotel with a yachting or marina service can be costly with upgrades, repairs, maintenance and storage expenses. Depreciation deductions can help to offset this expenditure, according to BMT Tax Depreciation.

With the weather warming, Australian waterways will soon be filled with boating enthusiasts gearing up for a busy summer. Almost five million people enjoy our waterways each year, from recreational boating and marine sports to chartered services.

For this reason, it’s important for hotel owners and operators offering these services to be prepared for the upcoming season. Owning and operating a hotel with a yachting or marina service can be costly. Upgrades, repairs, maintenance and storage expenses can tally up to a considerable amount. Fortunately, depreciation deductions can help to offset this expenditure.

Depreciation is generally the second biggest tax deduction after interest, though it’s often missed. This is because it’s a non-cash deduction, meaning an investor doesn’t need to spend any money to be eligible to claim it.

Depreciation deductions can be claimed under two categories. The first is capital works depreciation, which refers to the building’s structure and assets considered to be permanently fixed to the building. The second category is plant and equipment assets, which refers to the deductions available for easily removable fixtures and fittings within the property.

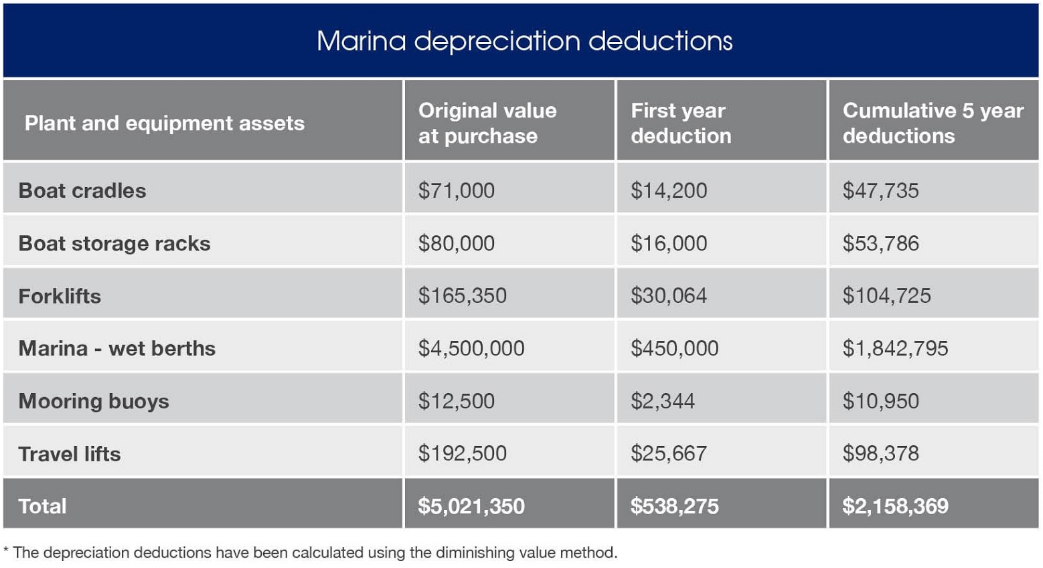

Let’s look at an example. The owner of a hotel featuring a marina is eligible to claim depreciation deductions on assets like boat cradles, boat storage racks, forklifts, wet berths, mooring buoys and travel lifts.

The following table lists examples of plant and equipment assets found at a marina and highlights each asset’s original value at purchase. It also shows the first year and cumulative five year deductions available for each asset.

Supplied: BMT Tax Depreciation

In this scenario, the owner is eligible to claim $538,275 in depreciation deductions in the first year alone. Over the cumulative five years, this figure will increase to more than $2 million. Given this scenario is based on just six assets found at the marina, there is likely to be hundreds of thousands of dollars more to be deducted.

On top of this, the owner can also claim depreciation deductions for the hotel building and the assets found within it.

To learn more about the depreciation deductions you can claim from your marina or yacht club, Request a Quote or speak with one of the expert team at BMT Tax Depreciation. Click here to view the BMT Tax Depreciation website or phone BMT Tax Depreciation via the contact details below.

This is a Sponsored Article.

Related Reading:

See the depreciation deductions available in a hotel room

How boutique hoteliers can boost their cash flow

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation