Hobart's hotel market was one the top performers for revenue per available room growth among the capital cities last year, data from CBRE has shown.

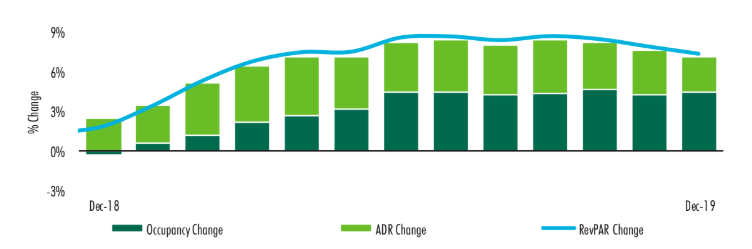

CBRE's Hotel Maketview for the fourth quarter of 2019 indicated the city's RevPAR increased by 7.9 per cent throughout 2019, joining Brisbane and Adelaide as the only capital cities to buck the national trend of decline.

At a glance:

- 6.8% decrease in nights spend in hotels to 2.2 million annually

- Of the hotel nights occupied by travellers, 69% were for holidaying, 22% for business trips and 6% VFR

- China, the US and Hong Kong are the dominant overseas sources accounting for 46% of hotel nights

- International guests accounted for 18% of total hotel nights

- NSW, VIC and TAS are the dominant domestic sources accounting for 70% of hotel nights

- Average length of hotel stay was 2.7 nights

According to the report, Hobart continues to benefit from a strong domestic visitor market, which accounted for 82 per cent of hotel nights for the year ending September 2019.

Source: CBRE

NSW, Victoria, and Tasmania are leading domestic sources, accounting for 70 per cent of hotel night, while of the nights occupied, 69 per cent were for holidaying, 22 per cent were for business trips, and 6 per cent VFR.

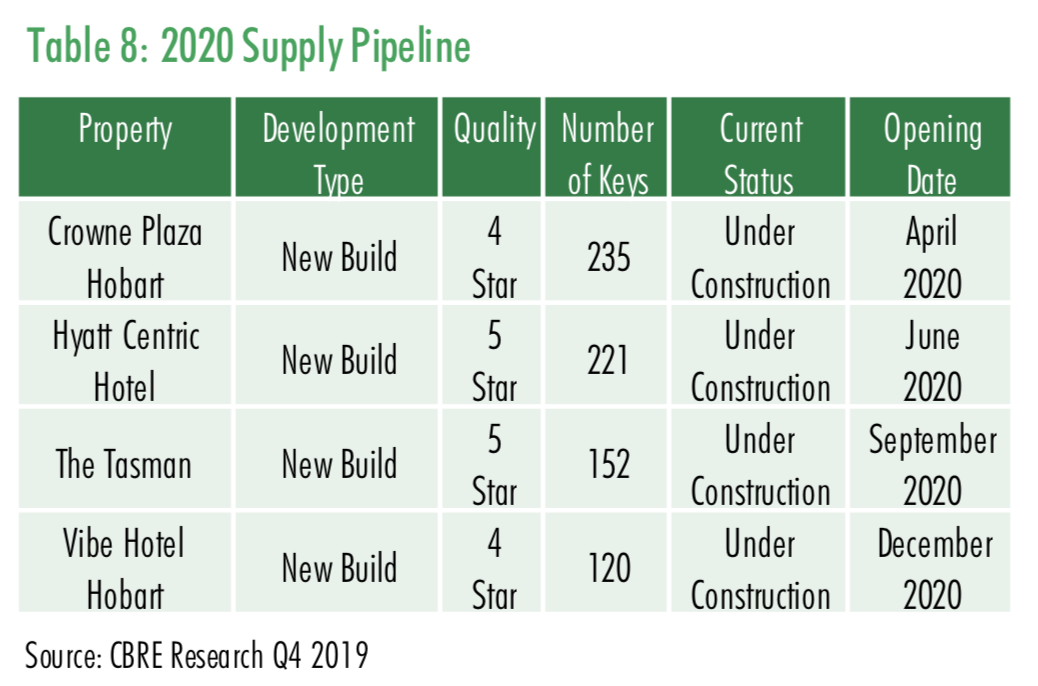

Going forward, the report notes that about 700 rooms are currently under construction in the city, representing about 20 per cent of the existing supply.

The Luxury Collection announces first hotel in Tasmania

Crown Plaza

Hyatt Announces Plans for First Hyatt Centric Hotel in Australia

CBRE believes this will likely place downward pressure on occupancy and resultant hotel performance as this stock enters the market.

The company also states the city's proximity to "key tourist attactions" will underpin room growth going forward.

Click here to download the report.

Similar to this:

Brisbane and Perth 'absorbing' increase in hotel supply: CBRE report

CBRE release their 2019 hotel market outlook research report

"Domestic demand in New Zealand offsets soft international numbers" - reports CBRE