Australia records second highest hotel transaction volume in Asia Q3 2017

Contact

Australia records second highest hotel transaction volume in Asia Q3 2017

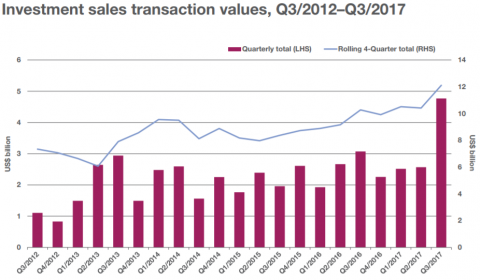

The total APAC hotel investment volume surged in Q3/2017 to US$4.77 billion, making this quarter the most active in 2017 so far, with Australia recording the second-highest transaction volumes with AU$496.4 million according to Savills November 2017 Hotel Research.

The third quarter of 2017 registered US$4.77 billion worth of investment transactions with a total of 115 properties changing hands across ten countries in Asia-Pacific. Collectively, the transaction amount in the third quarter of 2017 recorded a quarteron- quarter (QoQ) increase of 55.2% compared with Q3/2016, making Q3/2017 the most active quarter in 2017 so far.

Australia

Australia had the second-highest transaction volumes with AU$496.4 or US$384.9 million, keeping up with the transaction volume from the previous quarter. However, this represents a fall of 46.6 % compared to the country’s total transaction volume in Q3/2016. The most prominent sale was the acquisition of the 396-room Hilton Melbourne South Wharf by Singapore-based UOL Group, from Host Hotels & Resorts and Plenary Group, for AU$230 million or US$174.4 million.

After the acquisition, UOL plans to rebrand the hotel with its own hotel brand, Pan Pacific, in order to expand its portfolio presence in Oceania. Other transacted hotels this quarter were comparatively smaller deals in secondary locations, with the value of the transactions falling into the range of AU$6 to AU$70 million.

While the Australian market has continued to capture the interest of investors, especially Asian investors, with positive hotel demand and supply conditions and a consistently high hotel performance, domestic buyers were more active in Q3/2017, focusing on smaller properties in regional destinations.

Asia Market Overview

The largest transaction this quarter was the sale of Dalian Wanda Group’s hotel portfolio of 77 properties, across various cities in China, to Guangzhou R&F Properties who bought the hotels for RMB19.9 billion, or US$2.94 billion.

Combined with other transactions in China, the total transaction volume in the country reached RMB22.1 billion or US$3.35 billion.

Excluding the investment volume in China, it is observed that regional investors are more active in crossborder acquisitions with more investment activity taking place outside the key markets such as Hong Kong and Japan. In one noteworthy transaction, US-based Host Hotels & Resorts sold the Hilton Melbourne South Wharf to Singapore-based UOL Group for AU$230 million, or US$174.4 million.

In addition, Thailand-based Strategic Hospitality F&L REIT also purchased two Indonesian properties from Agung Podomoro Land for US$233.4 million. The signifi cant rise in total investment volume, QoQ, was mainly due to the increase in transactions in lower frequency hotel sale markets such as China, Indonesia and South Korea, where deals are often opportunistic and off-market. While these may not be the key markets where major investors are actively looking for acquisitions, some assets may bring strategic added value for investors.

Generally, investors are still on active lookout for stable investments to mitigate growth outlook, especially in established markets. It is also expected that some big ticket deals are in the pipeline to close by the end of the year.

Click here to download the Savills Hotel Sales & Investment Briefing November 2017.

To discuss the report in more detail phone or email Michael Simpson or Simon Smith of Savills via the below contact details.

See also:

JV announced for new $600 million 85 Spring Street hotel development