Savills release their Feb 2018 Hotels Market Report

Contact

Savills release their Feb 2018 Hotels Market Report

According to the report, hotels in Sydney and Melbourne are experiencing unprecedented trading performance, however there was a relative dearth of sales activity in 2017 with national transaction values down 35% compared to the 2016 calendar year.

Savills Hotel Market Report finds that there were no significant hotel sales recorded in Sydney’s core CBD and only a small number of investment grade hotel transactions in Melbourne’s CBD.

"Since the peak of transaction sales set in CY 2015, there has been a precipitous decline in the total dollarvalue of hotels transacted across Australia. Many owners seem to be opting to hold their hotels for fear of being cashed up without the ability to re-enter the market; which is becoming a self-fulfilling prophecy," states Managing Director of Savills Hotels, Michael Simpson.

"In 2018, we anticipate that Sydney and Melbourne markets will continue their strong trading performance given record international and domestic tourist numbers and visitor spend, and relatively muted supply growth."

"There continues to be a fairly substantial (and apparently growing) price gap between Buyers and Sellers. This “gap” is accentuated in Perth and Brisbane where Sellers consider Sydney and Melbourne cap rates as being applicable to their markets."

"We see counter cyclical opportunities in 2018 in Brisbane, which we consider has bottomed and will benefit from the Commonwealth Games and activities associated with the Queens Wharf development, as well as a number of other significant public infrastructure projects and large scale private developments. Conversely, Perth has additional new supply still to enter an already soft market, which in the short term will lead to further downward pressure on both occupancy and room rate. Likewise, this should give rise to buying opportunities for well capitalised counter-cyclical investors."

"We are expecting developers in Sydney and Melbourne to exit their hotels to take advantage of robust capital values, lack of availability of existing investment grade hotels, and to capture the ubiquitous and deep pools of capital still searching for hotels in these key markets. The Developers exit point will be either a site sale with associated DA, turnkey sale with fund through obligations or project take out at completion."

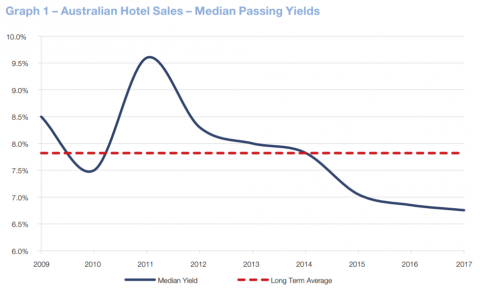

Yield compression continues as the dearth of opportunities drives up pricing and leads to tighter yields.

To read Michael's full article and view sales data, trends, and specific capital city overviews, click here to download the full Savills Hotels Market Report Feb 2018.

To discuss the Australian Hotel Market in further detail, contact Michael Simpson or Vasso Zographou of Savills Hotels via the below details.

See also:

Cairns pips Canberra for top spot as hotels market set for stronger year