Indonesia’s star-rated hotel occupancies continue to recover - HIS

Contact

Indonesia’s star-rated hotel occupancies continue to recover - HIS

According to Hotel Investment Strategies CEO and Founder Ross Woods, the monthly occupancy for Indonesia’s star-rated hotels will continue to lag occupancies until April 2023.

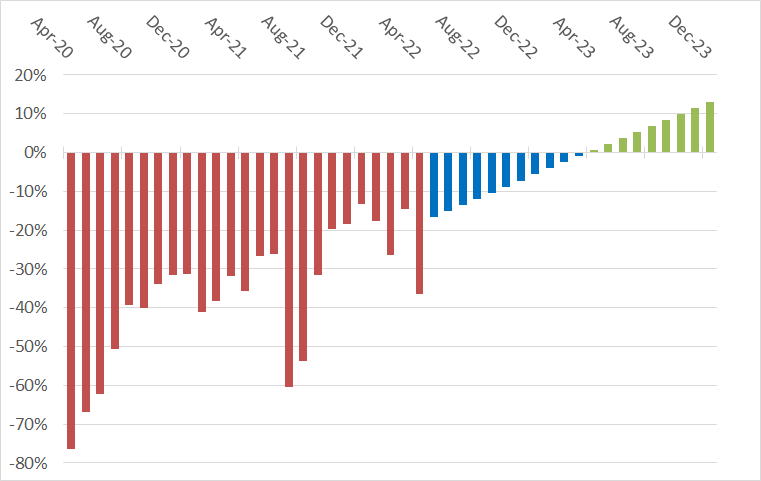

It’s been just over two years since the onset of the pandemic and the dramatic decline in hotel room occupancies across the country. Plummeting by 41.2 percentage points, room occupancies fell from 53.9% in April 2019 to 12.7% in April 2020. While occupancies are recovering across the country, current occupancies still lag the occupancies recorded in 2019, the year preceding the onset of the pandemic.

Based on current trends we believe the monthly occupancy for Indonesia’s star-rated hotels will continue to lag occupancies recorded in 2019 until April 2023 as illustrated by the change in monthly occupancy in the accompanying graph. Fourteen provinces, including Riau and Banten, are likely to recover in 2Q2022.

Three provinces, including Jawa Barat and Nusa Tenggara Barat, are likely to outperform 2019 occupancies in 3Q2022 and eight provinces, including Lampung and Jawa Timur in 4Q2022. Four provinces including Jakarta are likely to outperform 2019 occupancies in 2023, and five provinces including Bali and Kepulauan Riau are not likely to outperform 2019 occupancies until at least 2024.

Over the past couple of years, our predictive models and forecasts were challenged by a myriad of risks. We continued to provide our clients probabilistic forecasts on a range of variables including international and domestic visitor arrivals, and hotel metrics such as occupancy and room rates. During the early stages of the pandemic, we said that “making detailed projections about the timing and nature of the recovery of Indonesia's hotel sector might seem like a fool’s errand”.

The same cannot be said today. Things are becoming clearer, despite lingering uncertainties.

For more information or to discuss how we can help you with your hotel market forecasting needs, contact Hotel Investment Strategies CEO and Founder Ross Woods via the contact form below.