Domestic tourism improves but inflationary pressures bring roadblock

Contact

Domestic tourism improves but inflationary pressures bring roadblock

According to Vanessa Rader, Head of research, Ray White Commercial, the hotel sector is showing signs of return to pre-pandemic occupancy, while room rates forge ahead.

The pandemic did much to pressure the tourism market, with lockdown restrictions forcing border closures, and the grounding of planes which saw both domestic and international travel halt, hurting Australia’s tourism industry. Hotel assets saw occupancy levels fall to never before seen lows and average daily room rates (ADR) sat in a state of limbo while hotel owners waited out the closures. While local travel slowly came back online, subsequent borders opening up resulted in an increase in road trips and exploring, not just CBD locations but regional markets, creating a new buzz for accommodation assets.

It wasn’t until borders opened back up that we started to see a greater uptick in occupancy levels and ADR, as confidence returned to get on planes and visit domestic holiday destinations. This has been moving in a positive direction over the last two years but current results are yet to eclipse pre COVID-19 levels. Domestic aviation statistics in March 2023 were up 31.8 per cent over the last year to 5.16 million passengers, edging closer to the 2019 results. The busiest routes this year being Melbourne to Sydney, which signals an increase in business travel, while activity at the Gold Coast airport has been particularly robust.

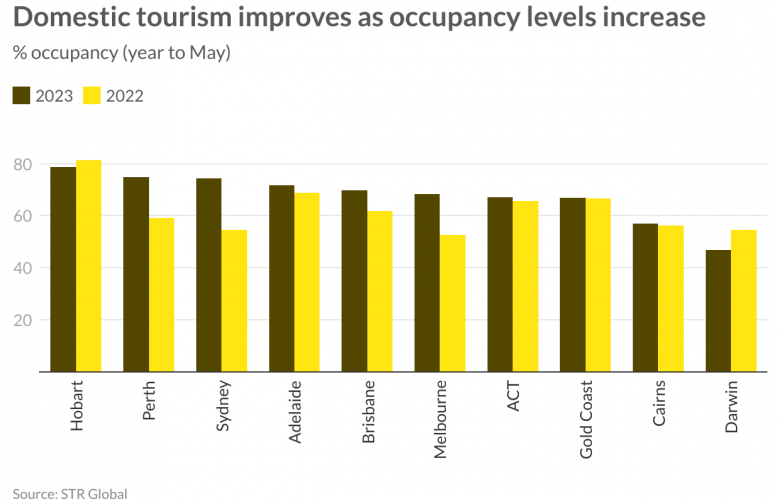

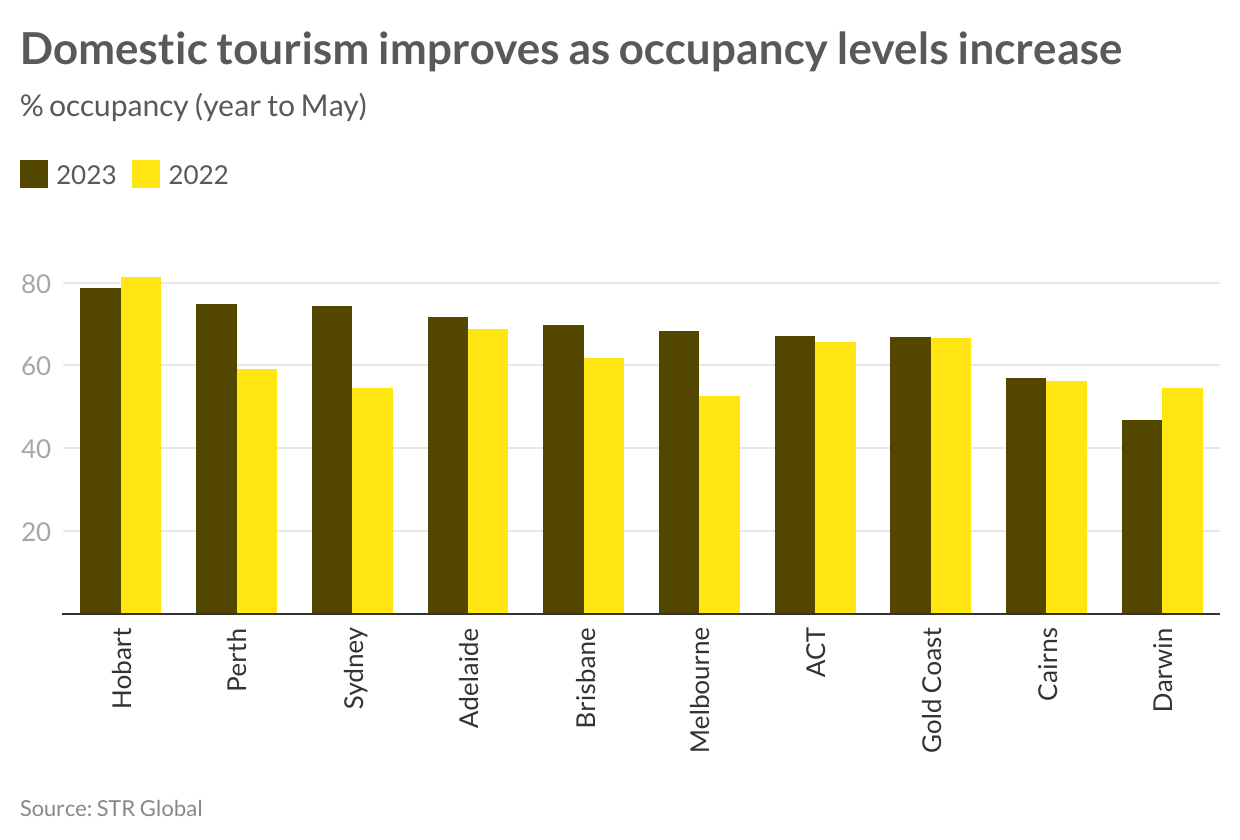

For hotel occupancy the uplift has been outstanding over the past year. Despite many households tightening their belts given inflation pressures and rising interest rates, holidaying has remained a high priority for many Australians. Similarly, work related travel has come back online after zoom fatigue set in, virtual conferences started to wrap up seeing corporate travel rebound. Hotel occupancy has been up across most markets, albeit not back to pre pandemic rates. Busy tourism locations such as Hobart and Darwin have shown some slowing after a busy 2022 period which saw travellers opt to explore domestically with rules and uncertainties around international travel continuing. The Gold Coast, however, has remained steady as an attractive visitor location over the last couple of years.

Perth and Sydney tourism regions have seen strong improvement to average annual occupancy at 74.9 per cent and 74.5 per cent respectively for March 2023. Perth is one of the markets achieving occupancy back to pre-pandemic results averaging 72 per cent in March 2019, while Sydney still has some way to go to achieve the 85.5 per cent average achieved in the same period. Melbourne is in a similar situation with 2019 results of 85.5 per cnet well ahead of current averages of 68.4 per cent.

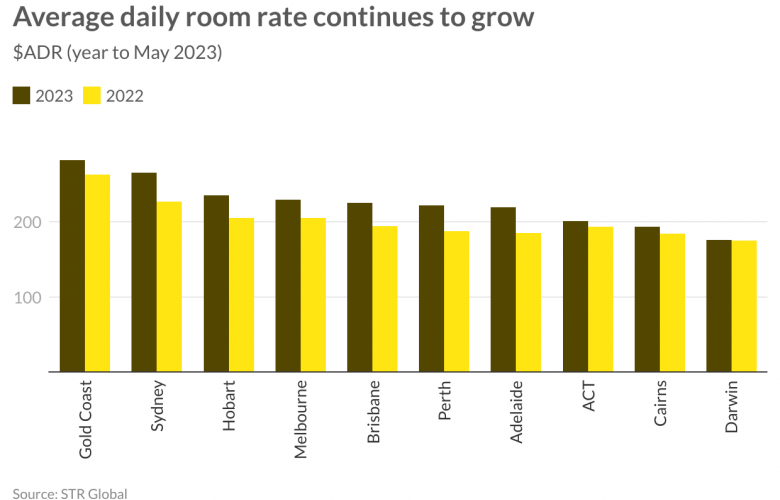

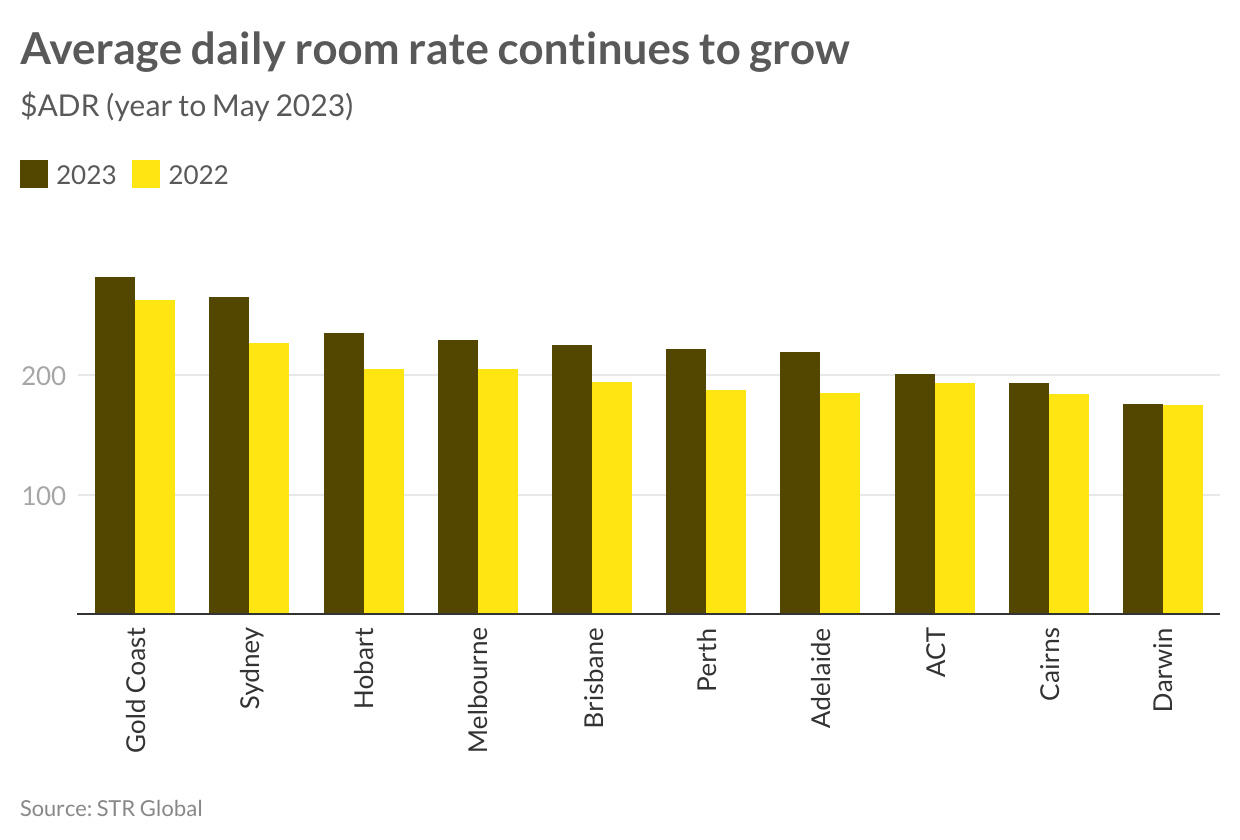

Although occupancy may not have fully recovered, ADR has continued to grow across all regions setting new benchmarks in rates. A combination of difficulty in staffing causing wage pressure and inflationary increases on goods has been the catalyst for this growth.The Gold Coast is currently home to the most expensive accommodation at $282.18 per night, up 7.24 per cent in the last year, but more than 40 per cent up on the annual average rate in May 2019. Markets such as Sydney and Melbourne have increased in the last year to $265.79 and $226.97 per night respectively, however, since 2019 growth has been sub 20 per cent, highlighting increased demand in tourism nodes such as Gold Coast and Hobart over business travel hotspots.

Despite some mismatch in these indicators, the hotel sector is showing signs of return to pre-pandemic occupancy, while room rates forge ahead. The high inflationary environment and increases in interest rates may have dampened some domestic demand, but business travel and international visitors have had a positive impact on the broader tourism market, aiding the hotel sector.

Insights by Vanessa Rader, Head of research, Ray White Commercial.