Hotel spas hold deluxe depreciation deductions - BMT

Contact

Hotel spas hold deluxe depreciation deductions - BMT

BMT Tax Depreciation discuss how hotel spa upgrades improve depreciation deductions and how government incentives can optimise cash flow for hotel operators.

By enhancing spas and well-being facilities, hotel operators can increase the value of their property, enhance guest enjoyment, and ultimately boost profits. We explore how hotel spa upgrades improve depreciation deductions and how government incentives can optimise cash flow for hotel operators.

What is a hotel spa?

A hotel spa is a facility or section within a hotel that offers various wellness and relaxation services to its guests. It’s designed to provide a range of spa treatments and therapeutic activities, aiming to promote physical and mental well-being, relaxation, and rejuvenation. Hotel spas are typically equipped with professional therapists, modern amenities, and a serene ambience to create a tranquil environment for guests to unwind and escape from the stresses of daily life.

What depreciation looks like in a hotel spa

Tax depreciation is a tax deduction claimed for the natural wear and tear of an income-producing building and its assets over time. Regardless of the type or size of a hotel spa, depreciation deductions are typically available.

In a hotel spa, capital works are depreciated at either a rate of 2.5 per cent or 4 per cent based on the construction commencement date. Plant and equipment assets follow a set depreciation rate determined by the effective life of each asset, as prescribed by the Australian Taxation Office (ATO).

The depreciation eligibility of a spa depends on its ownership and management structure. If the spa is run and owned directly by the hotel, the hotel owner is entitled to claim all available depreciation deductions. However, if the spa is owned by the hotel operator but leased to a tenant, depreciation deductions are available to both parties but are claimed differently, reflecting their respective ownership arrangements.

Because spas require a unique fit-out, it’s not uncommon for the tenant to complete renovations and capital works upgrades which qualifies them to claim those deductions.

Government-introduced incentives

The Australian Government introduced the Small Business Energy Incentive and temporarily extended the Instant Asset Write-Off as part of the 2023 Federal Budget.

Under the Instant Asset Write-Off, businesses with an aggregated turnover of less than $10 million can immediately deduct the full cost of qualifying assets less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. This is on a per-asset basis, meaning multiple assets can be written off as long as they qualify.

Under the Small Business Energy Incentive, businesses with an aggregated turnover of less than $50 million, can deduct an additional twenty per cent of the cost of eligible depreciating assets that support electrification and more efficient use of energy.

These incentives only accelerate plant and equipment depreciation, they don’t affect capital works deductions.

We compare one scenario with two different depreciation outcomes following renovations and the installation of new assets. In the first scenario, the owners apply the Instant Asset Write-Off along with the Small Business Energy Incentive. In the second scenario, the owners don’t apply any incentives and claim depreciation under general depreciation rules.

The case study below is fictional and doesn’t represent a real establishment.

Case study: Depreciation deductions in a hotel spa

In Yarra Valley, Victoria, “Valley Resort” stands as an owner-operated establishment featuring more than thirty guest rooms and an array of amenities. These facilities include a restaurant and bar, a golf course, a business centre, a kids club, a gym, a games room, a guest shop, tennis courts, a swimming pool, and a deluxe day spa.

In anticipation of the approaching holiday season, the spa underwent renovations and the installation of new assets. The renovations included plant and equipment and capital works upgrades. Among the plant and equipment upgrades were the installation of new treatment tables, light fixtures, spa furniture, kitchen assets and a computer. The capital works upgrades involved fitting new flooring, shelving, bathtubs, and basins and revamping the sauna. Part of these upgrades comprised energy-efficient assets which qualified for the Small Business Energy Incentive.

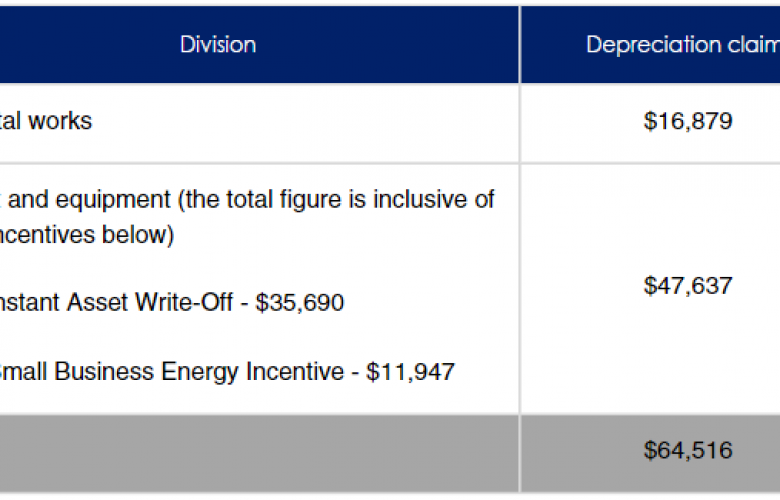

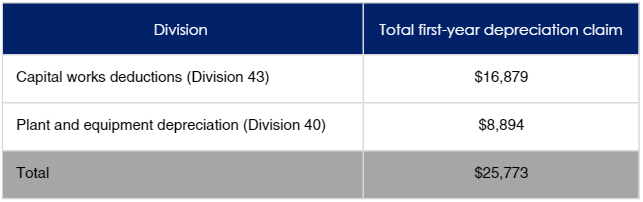

Table 1: Government incentives applied

Table 1 demonstrates the deductions generated by the upgrades in the first financial year with a breakdown of the incentives applied.

Because the incentives don’t affect capital works, they’re depreciated under general depreciation rules.

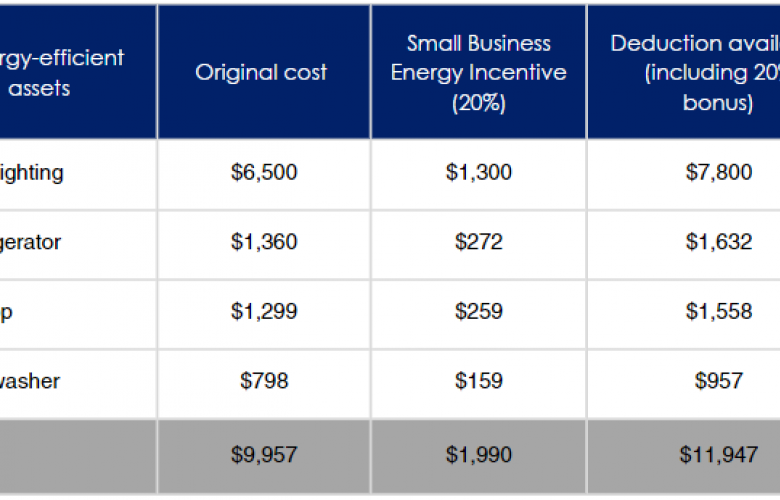

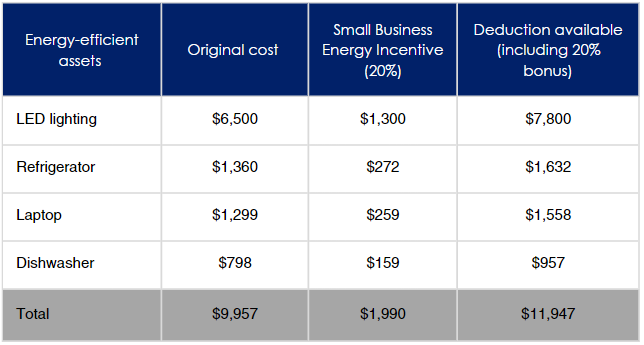

Energy-efficient assets were installed as part of this upgrade, which produced a twenty per cent bonus on the original cost of qualifying assets. The breakdown of how the Small Business Energy Incentive was applied is shown in Table 2.

Table 2: Application of the Small Business Energy Incentive

This $11,947 deduction is on top of the Instant Asset Write-Off, bringing the total plant and equipment deduction to $47,637.

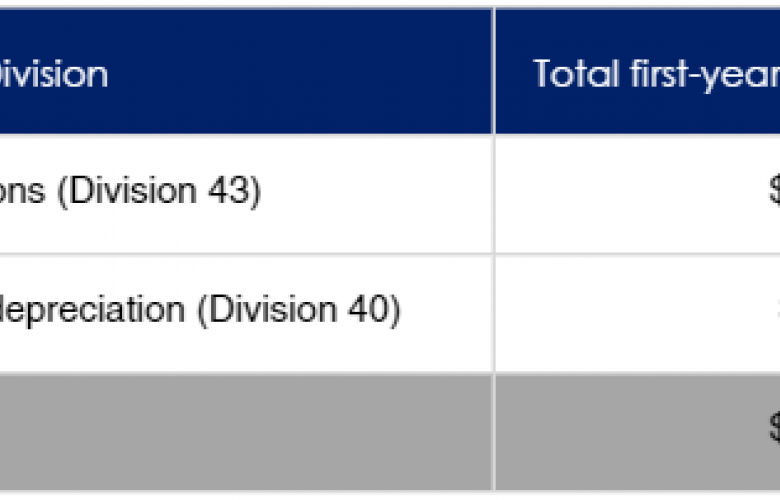

Table 3: General depreciation rules applied

As a comparison, Table 3 shows what the depreciation deductions would be without the Instant Asset Write-Off and Small Business Energy Incentive applied (i.e., with general depreciation rules applied).

The deductions displayed in the case study above encompass only the deductions resulting from the upgrades and do not encompass a comprehensive annual depreciation claim for the entire Valley Resort.

In Table 1, the Instant Asset Write-Off facilitated the immediate claiming of eligible assets, resulting in accelerated deductions. Additionally, by leveraging the Small Business Energy Incentive, Valley Resort was able to secure an extra twenty per cent bonus on qualifying energy-efficient assets. By applying the incentives, the owners of Valley Resort were able to claim an additional $21,864 in comparison to what they would have claimed if they followed the general depreciation rules. This approach proves advantageous for hotel operators aiming to offset a higher tax liability in the upcoming financial year.

The upgrades revitalised the day spa, which encouraged guests to book treatments in turn improving the profitability and booking rates of the spa and hotel.

Applying these incentives won’t be suitable for all hotel operators, so, it’s important that they consult an accountant or financial adviser before deciding.

How hotel operators can maximise depreciation deductions

To maximise depreciation deductions, it’s essential for hotel operators to organise a site inspection for the preparation of their tax depreciation schedule. Missing out on a site inspection will likely result in missing out on thousands of dollars in deductions.

BMT Tax Depreciation conducts site inspections to ensure deductions are maximised and fully compliant with current ATO rulings and regulations. BMT also applies government incentives where applicable.

To find out more about the depreciation deductions within hotel spas, call BMT on 1300 278 726 or Request a Quote.

The information in this article is general in nature and shouldn’t be taken as a quote or a guaranteed outcome.

Related Reading:

Hotels go green – improve sustainability by claiming depreciation deductions - BMT